I really don’t like health insurance companies. To be fair, what I’m trying to say is I really, really don’t like heath insurance companies. Granted, I appreciate they are just one part of the enormous mess that is the healthcare system, but they tend to be the most visible to me as the CFO here at EWI.

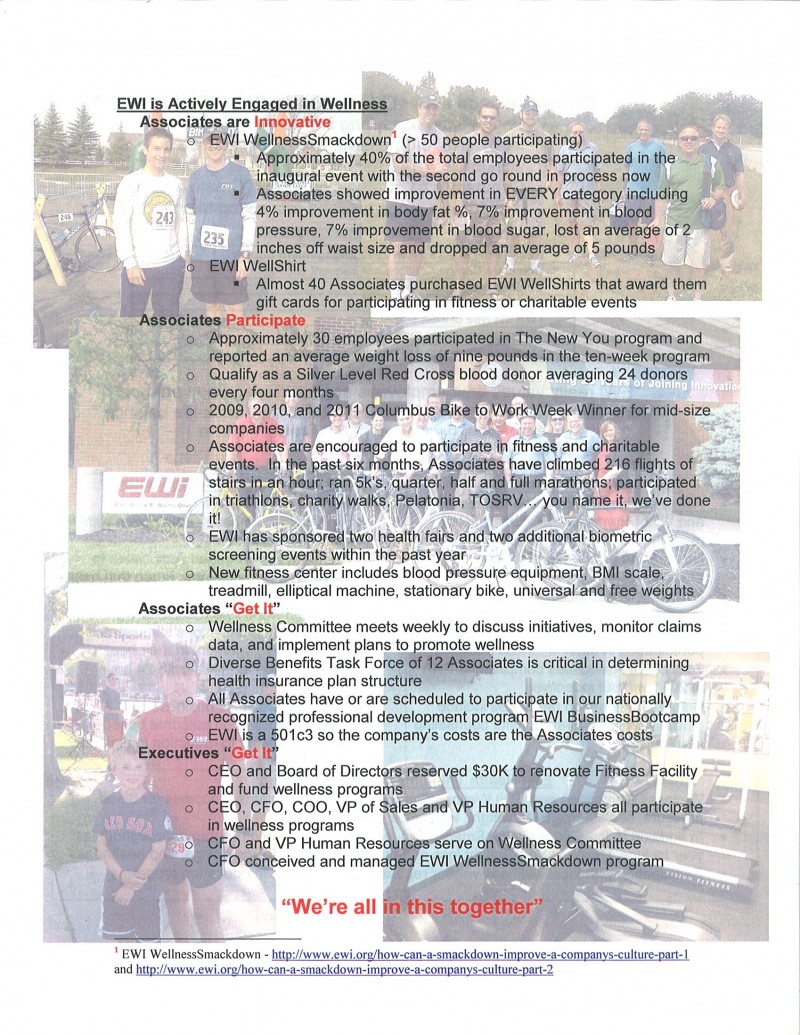

We take our health very seriously here. We have an educated workforce, a highly engaged wellness committee, and Associates who appreciate that we’re a 501c3 (meaning EWI’s costs are their costs). As health insurance is the 2nd largest single expense line on EWI‘s P&L everyone cares.

We just completed our renewal “discussions” with our incumbent provider and it was very painful. Painful because of the increase, sure, but painful because of the amount of “smoke” that is emitted during the meeting. We have our carrier provide a detailed account of how the renewal percentage is arrived at in order to try and better understand areas we can target with our wellness program to improve ourselves for next year… But every step included mystical assumptions and magical prospective looks. At one point the actuarial, after my repeated questions, actually acknowledged how torqued I was saying “I know how frustrating this must be for you… I’m a numbers guy and need to be able to tie things out”. With our current healthcare system there is little meaningful transparency, seemingly no cap on costs, and you certainly can’t hope to be able to “tie things out”.

The good news is we have Associates who are committed to doing everything we can to drive as much cost out of the plan as possible. Mark Matson, our VP of HR, along with the members of the wellness committee are continuing to implement programs and best-practices in order to do what we can. Whether it results in lower premium increases or not (what a moronic plan where the best we can hope for is a smaller increase) it will at least have the impact of healthier EWI Associates. This year, based upon the qualitative feedback from our broker and the quantitative results from the carriers, it seems our wellness efforts as a company as well as the time we’ve invested to understand the numbers has begun to pay off.

If you have any thoughts, comments, or suggestions you would like to share, please feel free to post below or send me an email at [email protected] or Mark Matson at [email protected].